Whole Life Insurance Rates For 61 Year Old Male

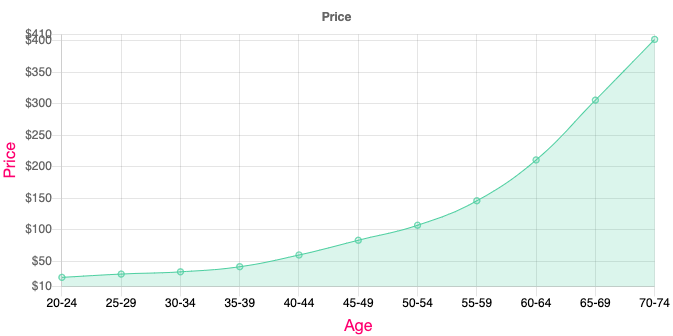

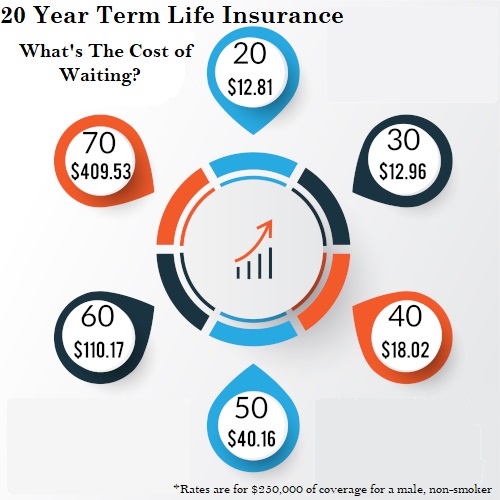

It s possible to get life insurance after 70 but your options will be limited and you can expect to pay substantially more for coverage a person in their 80s can expect to pay more than 1 000 a year for a 10 000 or 20 000 final expense or guaranteed issue policy.

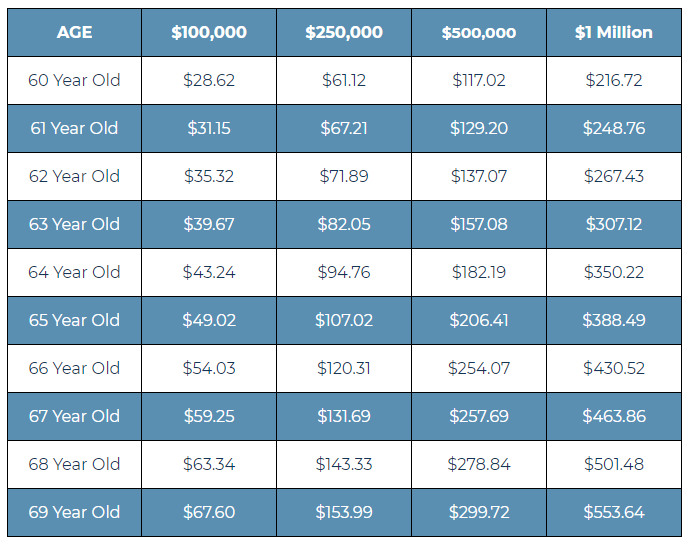

Whole life insurance rates for 61 year old male. Sample permanent insurance premiums for a 61 year old man. Cost of life insurance for people over the age of 70. These are example premiums for a man who doesn t smoke and is in good health. For a 62 year old female a 100 000 20 year term life insurance policy costs around 53 per month.

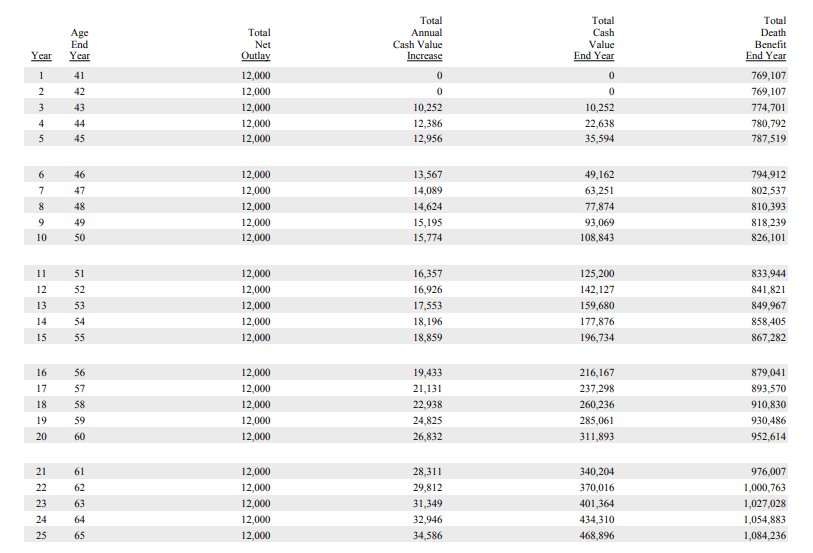

500 000 10 year term life insurance policy. A 61 year old male is 343 per month. You should think of this number strictly as a baseline your own rates for life insurance will change depending on your age the insurer you choose and the amount of coverage that you find is right for your family. A 61 year old male is 189 per month.

A 58 year old male will pay around 80 per month. I mentioned above that term insurance is much cheaper than whole life insurance. A 61 year old female is 124 per month. These are actual rates for a 500 000 20 year term insurance policy.

A 61 year old female is 83 per month. Rates will be higher if you have health problems. Monthly rates are for informational purposes only and must be qualified for. We ve found that the average cost of life insurance is about 126 per month based on a term life insurance policy lasting 20 years and providing a death benefit of 500 000.

A 61 year old female is 291. Your rates may vary depending on other factors. A 61 year old male is 126 per month. 100 000 whole life insurance.

You ll skip the medical exam in exchange for higher rates and lower.